6 Simple Techniques For Clark Wealth Partners

Table of ContentsThe 3-Minute Rule for Clark Wealth PartnersGetting My Clark Wealth Partners To WorkIndicators on Clark Wealth Partners You Need To KnowClark Wealth Partners Things To Know Before You Get ThisThe Greatest Guide To Clark Wealth PartnersAll about Clark Wealth PartnersFascination About Clark Wealth Partners

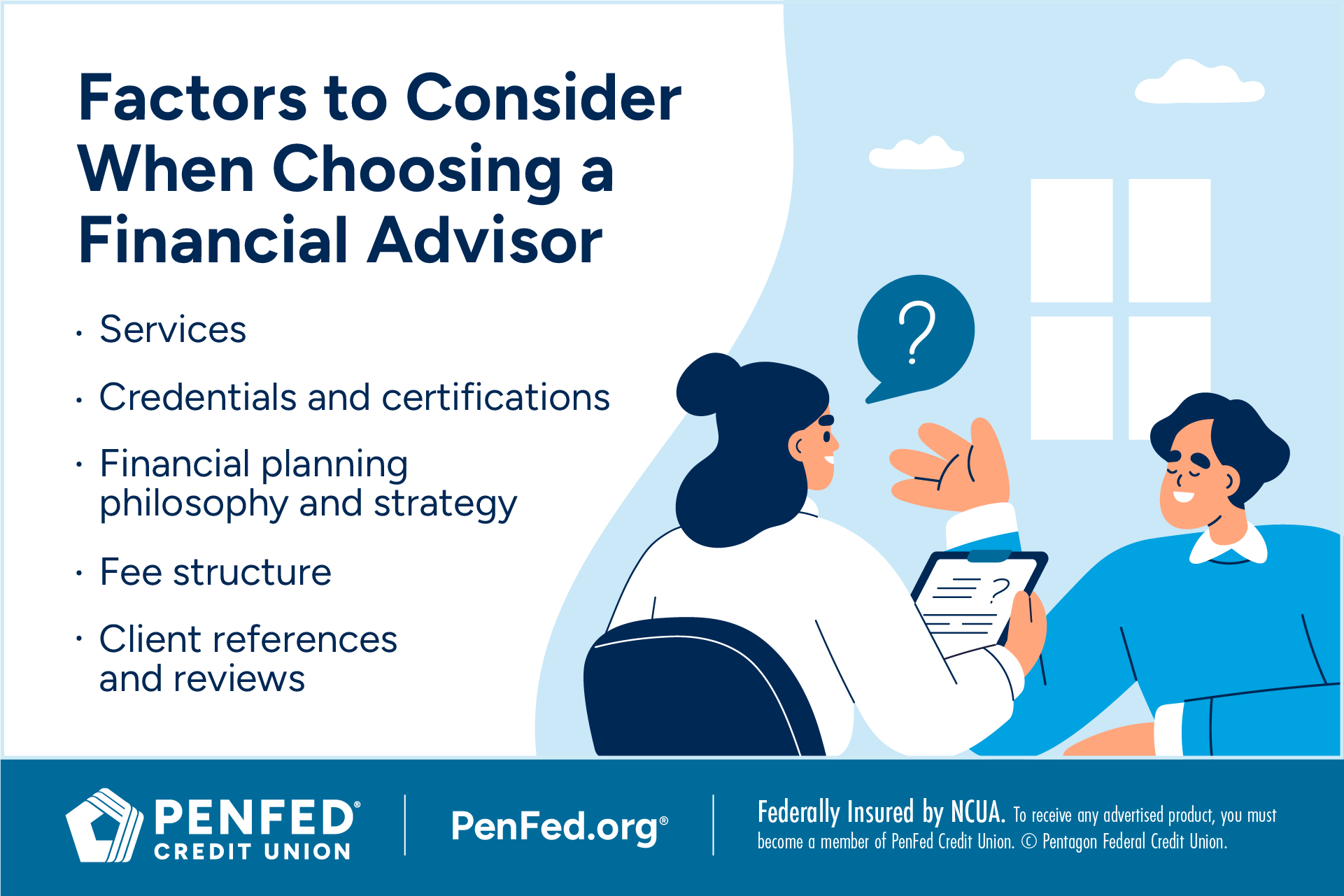

These are professionals who offer investment advice and are registered with the SEC or their state's safeties regulatory authority. NSSAs can aid elders make decisions regarding their Social Safety and security advantages. Financial consultants can also specialize, such as in student financings, elderly demands, taxes, insurance coverage and other aspects of your financial resources. The qualifications needed for these specializeds can differ.Only economic advisors whose designation needs a fiduciary dutylike qualified economic coordinators, for instancecan say the same. This distinction also means that fiduciary and economic advisor fee frameworks differ as well.

Clark Wealth Partners for Dummies

If they are fee-only, they're most likely to be a fiduciary. If they're commission-only or fee-based (implying they're paid via a combination of charges and payments), they could not be. Lots of qualifications and designations need a fiduciary obligation. You can examine to see if the professional is signed up with the SEC.

Picking a fiduciary will ensure you aren't steered toward specific financial investments because of the payment they provide - financial advisors Ofallon illinois. With lots of cash on the line, you might want a financial specialist that is legally bound to utilize those funds thoroughly and only in your ideal passions. Non-fiduciaries might suggest investment items that are best for their pocketbooks and not your investing goals

Getting My Clark Wealth Partners To Work

Rise in savings the ordinary home saw that functioned with a financial consultant for 15 years or even more compared to a similar house without a financial consultant. "More on the Worth of Financial Advisors," CIRANO Project Reports 2020rp-04, CIRANO.

Financial advice can be helpful at transforming factors in your life. When you satisfy with a consultant for the first time, work out what you desire to get from the suggestions.

Clark Wealth Partners Things To Know Before You Get This

Once you have actually agreed to go ahead, your monetary consultant will certainly prepare an economic strategy for you. You ought to constantly really feel comfortable with your advisor and their guidance.

Firmly insist that you are alerted of all transactions, which you receive all communication related to the account. Your consultant may recommend a handled discretionary account (MDA) as a way of handling your financial investments. This includes authorizing a contract (MDA contract) so they can buy or market financial investments without having to talk to you.

Clark Wealth Partners for Dummies

To shield your cash: Don't offer your adviser power of attorney. Firmly insist all correspondence regarding your investments are sent out to you, not simply your adviser.

If you're moving to a new advisor, you'll require to prepare to move your economic documents to them. If you require aid, ask your consultant to explain the process.

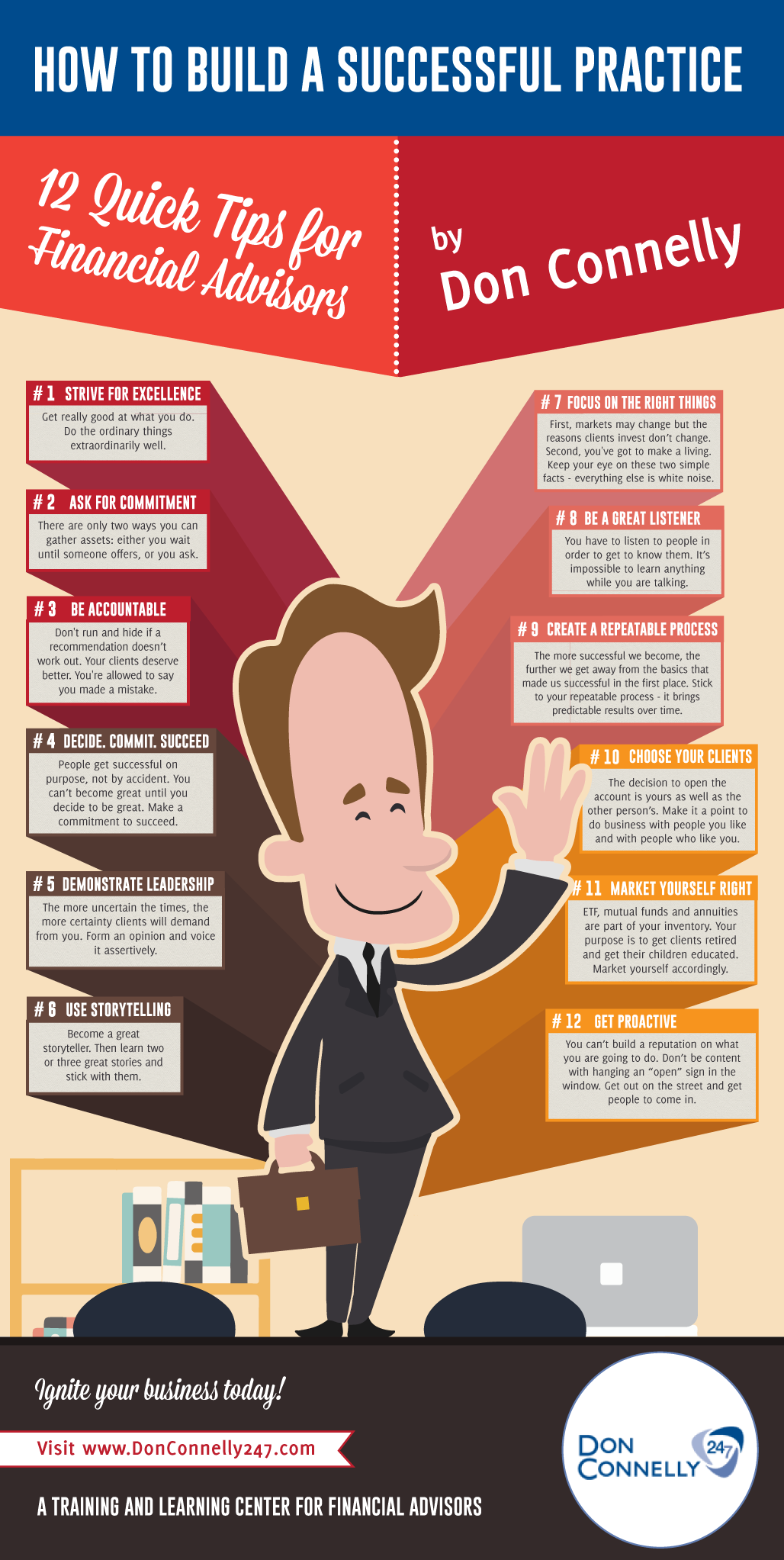

will retire over the next years. To fill their shoes, the country will need greater than 100,000 new financial experts to get in the market. In their day-to-day job, monetary advisors manage both technological and imaginative jobs. U.S. News and Globe Record placed the function among the leading 20 Finest Service Jobs.

Getting The Clark Wealth Partners To Work

Aiding individuals accomplish their financial objectives is an economic advisor's primary feature. They are likewise a small business owner, and a section of their time is committed to handling their branch workplace. As the leader of their practice, Edward Jones financial advisors require the leadership skills to work with and manage team, in addition to the reference organization acumen to create and perform an organization approach.

Financial advisors invest time each day seeing or reading market news on tv, online, or in profession publications. Financial consultants with Edward Jones have the advantage of home office research teams that assist them keep up to date on stock recommendations, mutual fund administration, and extra. Spending is not a "set it and forget it" activity.

Financial consultants should arrange time each week to satisfy brand-new individuals and capture up with the individuals in their round. Edward Jones financial advisors are fortunate the home workplace does the hefty training for them.

Clark Wealth Partners Can Be Fun For Everyone

Edward Jones economic consultants are urged to pursue added training to broaden their understanding and abilities. It's likewise a good idea for economic advisors to participate in industry conferences.